Blog

Why Ottawa?

Here’s why savvy investors are turning their attention to the nation’s capital

1. High Student Population Feeds Rental Demand

In Ottawa, the lively student life is a key driver of the housing market. With a vibrant student population that makes up a large chunk of the city’s heartbeat, there’s always a need for places to live. Universities like the University of Ottawa, Carleton University, and Algonquin College enrich the city’s academic vibe and make it a hotspot for those looking to invest in property.

Take the University of Ottawa, which sits at the heart of the student rental scene. It’s a bustling hub with over 40,000 undergraduates and 6,000+ graduates looking for their next home away from home. These students come from all over the globe—over 10,600 international students from 150 different countries, to be exact, adding up to 26% of the student body. Carleton University adds its own flavor to the mix, increasing the demand for rentals even more.

What’s really exciting for investors is how this student community is always growing and changing, bringing a kind of energy that doesn’t fade even when the economy slows down. Education is a constant, which means investing in student housing in Ottawa isn’t just smart—it’s a strategic move to build a diverse portfolio that benefits from the city’s strong educational backbone.

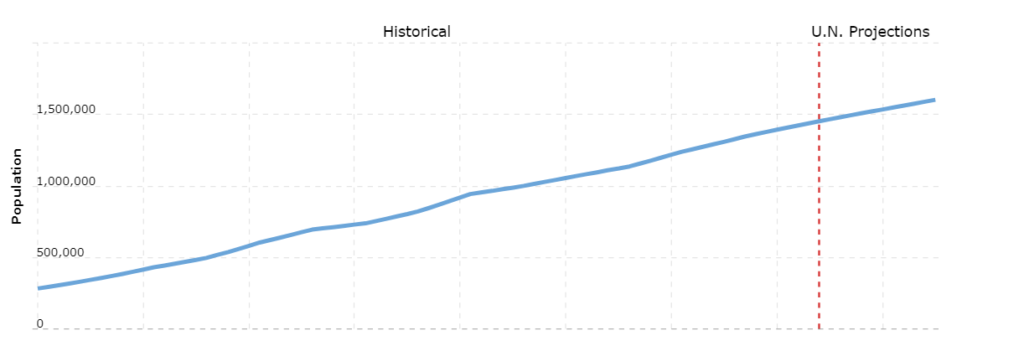

2. Milestone Population Growth and Major Developments

Ottawa’s population growth and the development of major infrastructure projects are crucial factors contributing to the real estate market dynamics. Crossing the 1 million population mark, Ottawa’s urban appeal is on the rise, and this is bolstered by significant capital investments in infrastructure that enhance the city’s connectivity and accessibility, as well as cultural and educational aspects.

The Light Rail Transit (LRT) System, specifically, is a monumental investment in the city’s public transportation infrastructure. The planned expansion of the O-Train network includes extending service south from Little Italy to Riverside South and an eastward extension through Orléans to Trim Station set for 2025. Additionally, a westward expansion to Algonquin Station and service to Moodie Station will follow in 2026. These expansions encompass over 44 kilometers of rail and the addition of more than 24 new stations, which will undoubtedly enhance the connectivity of the city, saving commuting time and potentially boosting property values in the surrounding areas. The narrative continues with Ādisōke, the forthcoming Ottawa Public Library, destined to become an iconic nexus of culture and community.

At LeBreton Flats, a once-industrial tract is undergoing a complete transformation into a busy, mixed-use district. Here, residential, retail, and office spaces will be developed, and potentially energized by the prospect of a new arena that could become home to the Ottawa Senators, a beacon of city.

3. Stable Market with High Household Income

Ottawa stands out as one of Canada’s major cities with a relatively high average household income, which significantly contributes to the stability and resilience of its real estate market. As of 2020, the average household income in Ottawa was approximately $126,700 annually, well above the national median, indicating a substantial capacity for home ownership and investment among residents (Statistics Canada) (CareerBeacon). This financial stability, supported by high income levels, ensures a robust market less prone to fluctuations compared to other cities with lower average incomes.

The city’s economy benefits greatly from the public sector, which constitutes nearly a third of Ottawa’s workforce. This sector provides stable and reliable employment, contributing to the city’s economic resilience. Besides the substantial public sector, Ottawa’s economy has a dynamic knowledge-based industry, based in communications technology, software development, aerospace, defense and security, digital media, life sciences, and clean technology. These industries not only diversify the economic base but also create high-paying jobs that further support the real estate market by increasing the purchasing power of residents (Ottawa.ca).

Overall, the combination of high household incomes, a significant public sector presence, and thriving high-tech and knowledge-based industries contribute to making Ottawa’s real estate market stable and attractive for long-term investment.

5. Ottawa Is Rezoning & Plans For More Investment

In 2025, Ottawa is set to introduce a significant overhaul of its zoning laws, following the approval of a new Official Plan by the Minister of Municipal Affairs and Housing in November 2022. This ambitious initiative aims to align zoning regulations with the broader goals set out in the Official Plan, which includes managing growth and development through 2046. The new zoning by-laws will replace the current regulations established in 2008 and are designed to meet contemporary urban needs more effectively.

The upcoming rezoning in Ottawa is likely to create several opportunities for investors, making it an exciting prospect for those looking to engage with the city’s real estate and development sectors. Here are some key reasons why this could be beneficial for investors:

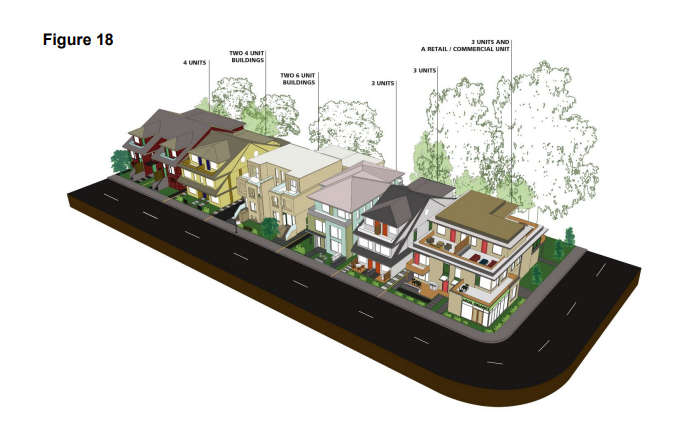

Increased Development Opportunities: The new zoning laws are designed to facilitate a variety of developments, including residential, commercial, and mixed-use projects. By aligning the zoning by-laws with the city’s Official Plan, the process for developing new properties will become more straightforward, potentially reducing the bureaucratic hurdles and costs associated with obtaining planning permissions (Engage Ottawa).

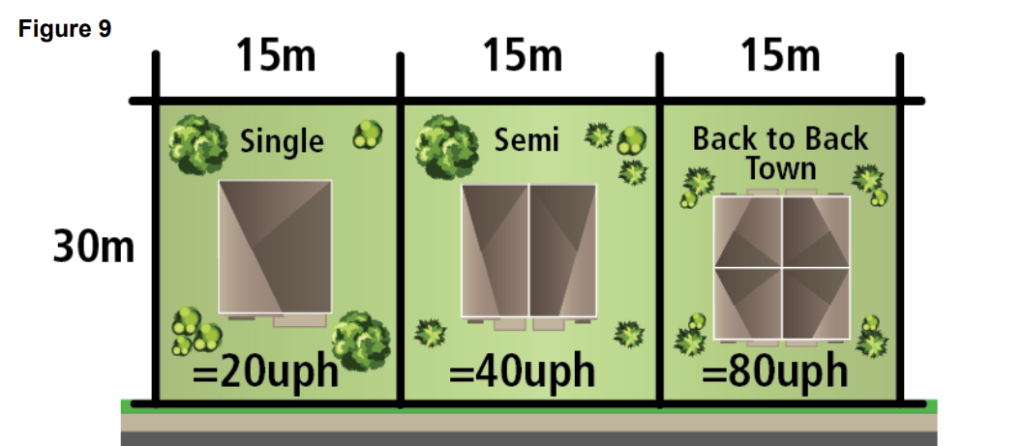

Focus on Diverse Housing Options: With an emphasis on increasing the supply of affordable housing and promoting “gentle intensification” (e.g., allowing up to three units on residential parcels), the zoning changes will open up opportunities to develop a range of housing types. This diversification can attract a broader market segment, including first-time home buyers, downsizing retirees, and renters looking for more affordable options (Engage Ottawa) (Engage Ottawa).

Enhancement of Property Values: The rezoning plan aims to improve the overall infrastructure and accessibility of various neighborhoods, which can lead to an increase in property values. As areas become more developed and desirable, properties within them are likely to appreciate in value, offering significant capital gains potential for investors.

6. Current Real Estate Market Trends

The Ottawa real estate market as of April 2024 shows a balanced environment with a recent increase in home values. The average home price rose by 7.1% from last year, now standing at $682,078. New listings increased by 13.5% year-over-year, providing a healthier inventory for potential buyers. Meanwhile, home sales dipped slightly by 2.4% compared to March 2023. Property values vary by type, with single-family homes, townhouses, and apartments all experiencing year-over-year increases in median selling prices. The market’s balance is also highlighted by homes selling just below the asking price. Although mortgage rates are higher than they were two years ago, the potential for them to decline could stimulate buyer activity later in the year. Compared to other major Canadian markets, Ottawa’s housing prices are more accessible, which could make the city an attractive option for buyers and investors.

Conclusion

Ottawa’s combination of a high student population, significant urban developments, economic stability, and positive market trends make it an excellent choice for real estate investment. Whether you’re looking to invest in student housing, residential properties, or commercial spaces, Ottawa offers a diverse and stable market with great potential for growth and returns.